The Los Angeles City Council has voted to move its money out of banks that fail to protect citizens from losing their homes. Dennis Santiago was in the room at the time and reports: Another landmark piece of legislation was passed today. The City Council of Los Angeles voted 12-0 to pass Councilman Richard …

Category Archives: Banking

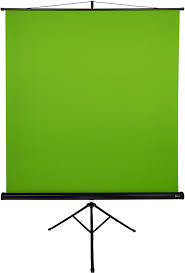

BREAK UP THE BANKS GREEN SCREEN CHALLENGE

Want to put your editing skills to the test and help put a stop to the big banks? Just take the video below, add whatever you want, and the best submissions will be featured here and at breakupthebigbanks.com. Got something to say? Say it! It could be funny, serious, romantic, whatever. Go to town, and make …

Continue reading “BREAK UP THE BANKS GREEN SCREEN CHALLENGE”

Small Business Lending from Big Banks

Stacy Mitchell, senior researcher for the New Rules Project’s Community Banking Initiative, explains that the big banks constrict credit for small businesses while community banks do disproportionately more small businesses lending, and what to do to allow them to get the economy moving again. Why is it that community banks do so much more small business lending …

Banking Kindred Spirits

Rev. Mario Howell, speaking as part of People Improving Communities through Organizing, led a prayer scolding Bank of America for the way they treat their customers. “We don’t want just one or two to get modifications,” he said, “we want everybody to get a modification! We want everybody to get a new loan! We want everybody …

FINANCIAL LITERACY MONTH

April is official Financial Literacy Month in the United States. In observance, we want to encourage everybody to take control of their finances by opening an account at a local community bank or credit union. Not only will you be treated like an actual human being instead of a number, but you will probably pay …

NEW MEXICO TO MOVE ITS MONEY

Legislators can move more than their money — they can put their tax revenues into small banks and credit unions, too. It empowers the local economy and puts a real confidence in community businesses. Arthur Delaney reports for the Huffington Post that Brian Egolf, a state representative in New Mexico has proposed that his state …

The First 90 Days

It’s hard to believe, but the Move Your Money campaign was started just over three months ago. That means that starting April 1, banks will begin reporting their first-quarter operating deposits to the FDIC. In other words, we’ll soon be able to see, in dollars and cents, how much of an impact the Move Your …

THE BIG BANKS’ PR PROBLEM

The New York Times’s Andrew Ross Sorkin has an article about the image problems that the big banks are facing right now. He asks whether it is a temporary problem or something much worse, and looks to the Move Your Money project as a sign that, for the big banks, things are serious. And the public outrage …

How to Find a Bank or a Credit Union

FIND A BANK/CREDIT UNION Not all community banks or credit unions are risk-free. Some of them got involved in the same risky behavior that took down some of the biggest banks. There are a few different ways to search for community banks and credit unions in your area, and most of them use slightly different …

Sodexo History Milestones

1966 Pierre Bellon launches Sodexhoin Marseille, founded on the Bellon family’s experience of more than 60 years in maritime catering for luxury liners and cruise ships. Operations initially serve staff restaurants, schools and hospitals. 1968 Operations commence in the Parisarea. 1971-78 International expansion begins with a contract in Belgium. Development of the Remote Site Managementbusiness, …